An effective 403(b) mortgage will be your own last resource since it is sold with significant troubles and you may threats.

For those who have a big bills approaching, however, you will be a small brief to your bucks, you may be given delivering that loan from your own 403(b) membership. Many 403(b) arrangements become a loan provision, that allows senior years savers short term usage of their money. But you will find several important information you must know to determine if or not a good 403(b) mortgage is your best option.

What exactly is good 403(b) financing?

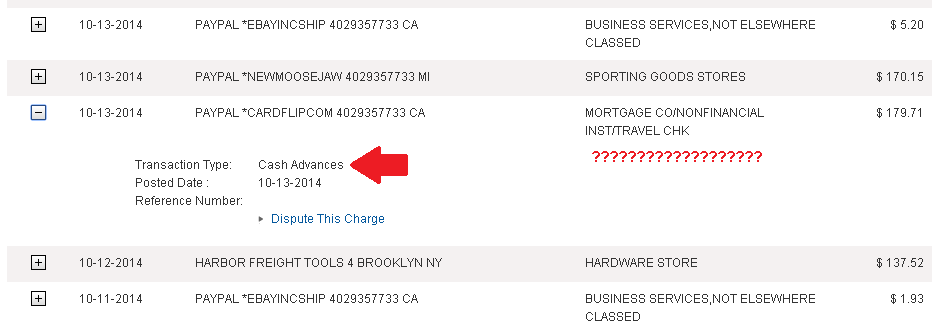

An excellent 403(b) financing is much not the same as that loan you can find off a lender. There is no credit assessment, and also the financing terms and conditions can be very good than those out https://paydayloanalabama.com/clay/ of a line of credit, an advance loan on your credit cards, if you don’t a guaranteed personal line of credit for example a HELOC.

Basically, you might be merely withdrawing funds from your 403(b) for the aim of getting all of them right back throughout the years. As long as you spend the money for cash back into schedule, you may not bear the fresh taxes and you may charges for the early distributions.

For each and every plan enjoys more words because of its mortgage solution, therefore it is important to remark the details with your package administrator. However the auto mechanics of 403(b) money all of the really works a comparable and require the same considerations.

Why does a great 403(b) mortgage works?

If you decide when deciding to take a loan from your 403(b), you’ll want to confer with your package officer and signal a beneficial mortgage agreement. The loan contract is always to detail the fresh terms of the borrowed funds — how much cash appeal possible shell out and how a lot of time you’re going to have to pay the loan.

The fresh new Internal revenue service puts a limit about much you can loan your self. The latest Internal revenue service limits the quantity so you’re able to 50% of the vested balance otherwise $50,000, whatever was shorter. When you yourself have lower than $ten,000 in your membership, the Irs permits you to do the complete balance given that a mortgage. Certain preparations might have more strict constraints.

The fresh Internal revenue service and additionally states that mortgage have to be paid off within the monthly installments happening at the least every quarter, and that it must be paid off in full inside 5 years. Once again, individual preparations possess more strict regulations.

After you’ve drawn the withdrawal, you are able to the cash to own everything you you want. For the time being, you should be enrolled and then make regular financing repayments from your own salary comparable to minimal percentage necessary to meet the terms of one’s financing contract.

In place of normal contributions toward 403(b), mortgage payments dont matter towards the your sum limitations. Brand new sum limit to possess 2024 try $23,000 ($twenty-two,five hundred for the 2023), or $31,five-hundred if you find yourself older than fifty ($30,000 into the 2023). Additionally, the interest portion of the loan payment try paid down having after-income tax dollars, whereas regular benefits are generally pre-taxation bucks.

If you possess the cash to repay the borrowed funds early, you could talk to the plan manager regarding starting a benefits declaration to expend the remainder balance.

Things to believe before taking aside an excellent 403(b) financing

While there’s no actual net appeal costs once the you are investing on your own the attention, you will find still a bona fide pricing to using the financing from your own coupons — the fresh new returns you would rating off staying the money spent.

The new S&P five-hundred averages more nine% returns a year more than four-year periods, but there’s a wide range of possibilities. It’s impossible to know what the business does along the lifetime of the loan, but it is likely to raise than just disappear, undertaking a cost with the mortgage. Whenever you get a consumer loan which have a fairly low interest rate, it is likely a far greater alternative than just providing a loan from your 401(k).

Furthermore, there are income tax ramifications to adopt. The eye you pay your self in the 403(b) account is managed once the immediately following-taxation currency. Which means you pay taxation in it now, and you may have to pay taxation inside again toward detachment whenever you are having fun with a vintage pre-tax 403(b) account.

If your 403(b) package also offers a specified Roth account and bring your mortgage detachment solely regarding you to definitely Roth account, you can steer clear of the double taxation on your notice commission. You can shell out taxation for the commission however, no income tax abreast of withdrawal.

The most significant risk would be the fact out of incapacity to settle. For individuals who eliminate your work, you will be expected to settle the entire balance of one’s mortgage all at once. If you can’t build the cash, the balance is handled as the a shipments subject to very early withdrawal charges and taxation. In order that “loan” may end right up costing you a lot more than a very old-fashioned one.

Make sure to think most of the significantly more than points when looking at the latest 403(b) financing solution. As with extremely monetary alternatives, there are pros and cons, and choosing affairs often concentrate so you can personal points.